How The US iGaming Market Compares To The Rest Of The World?

Demographics Of Sports Bettors In The U.S.

To differentiate the age, ethnicity and sex of sports bettors in the U.S., Dwyer, Hayduk and Drayer made a study comparing how players behave in legal states and in states where gaming is illegal. The study was conducted in 2021 but presents some interesting findings about the demographics of bettors and whether it changes between states where sports betting is legal or not.

According to this research in legal states the vast majority of bettors in legal states are male (78%), Caucasian (75%), in the Gen X age gap (51%) – the generation that was born between the 60s and 80s. The previous generation (baby boomers) follows up (27%), with Millennials also having a considerable percentage (17%). The younger generation, Gen Z, only averages 6%.

Meanwhile, still in the legal states, the vast majority of players have an income between $50.000 to $99.000/year (41%). The lower class, people with an income lower than $50.000 average for 35% of sports bettors in legal states.

In illegal states we do not see any major discrepancies compared to these numbers. However, when researchers looked up for appeal for gambling by region, they found that in illegal states the U.S. South states showed the higher interest than any other region (51%). Something which is understandable, considering most states in the South have not yet legalized sports betting, including Texas and Florida.

How U.S. compares to the rest of the world?

Europe

When compared to the 26 countries currently in the European Union, most of them have online gambling operators that are licensed and allow players to engage in poker, slots and roulette games, for example. Nonetheless, they still have some restrictions which allow only local brands to operate and even exclude some games (for example in Cyprus you can’t bet on horse racing events).

Asia

In Asia it’s a different story. Although there are some gambling capitals, like Macao in China, there are very strict laws against gambling in most countries. Until recently India allowed foreign gambling operators, but they have banned it from 2023.

Africa

Meanwhile, Africa has risen as an opportunity for foreign operators as two of major countries in the continent have legislated online gambling. South Africa was a pioneer, introducing legislation to regulate the market in 1990. Nigeria’s government who had outlawed online gambling in the past has recently introduced legal framework that allows operators to license their businesses in the country.

Australia & New Zealand

In what concerns the two major countries in Oceania online gambling and sports betting is legal. Although, in Australia you can only place online sports bets in bookmakers that are licensed in the country. Meanwhile, for online casino games, you can play them in Australia as long as the websites accept Aussie players.

What about New Zealand? Well, the laws for Kiwi players are similar to the ones that their Australian neighbors have. This means that if online sports betting companies and online casinos are registered and licensed in New Zealand and they operate under the laws in place they can perform their activity legal, and players are free to engage in gambling activities.

Latin America

In Brazil, the biggest country in South America, sports betting is legal since 2018. Meanwhile, online casino gambling is still illegal, but according to a recent survey almost half of Brazil’s population has admitted having played online casino games, mostly through their mobile devices. Even though it is illegal there are no arrests or charges for players, which unfortunately has seen the number of scammers grow in the past years.

Colombia has also adopted some legislation in 2016, but a couple setbacks has made online gambling be banned again. Private companies can still operate with government admission, but that has not stopped foreign investors from coming and using loopholes to be active in the country. As of the end of 2022, there were over seven million registered iGaming accounts, totaling a revenue of $5.3 billion a year.

Meanwhile, in Argentina, the current soccer world cup champion since last December, online gambling and sports betting is legal in most of the country. The major exception is the city of Buenos Aires, but it is expected that new legislation will cover the whole state soon.

Canada & Mexico

What about the two countries that border the U.S.: Canada and Mexico? Well, as for Canada, both online gambling and sports betting are legal. Many online casinos in Canada refer to Kahnawake Commission for registering and obtaining their license to operate legally. Still, there are many offshore casinos operating in Canada without repercussions. Sports betting is also mostly legal in all of Canada’s territory, although in the regions of Nunavut, Yukon and Northwest you can only bet on retail land based shops.

In Mexico online gambling is legal under certain conditions, since 2004. As long as operators respect the regulations of federal games and draws law. Also, sports betting is legal and heavily promoted, especially in soccer games.

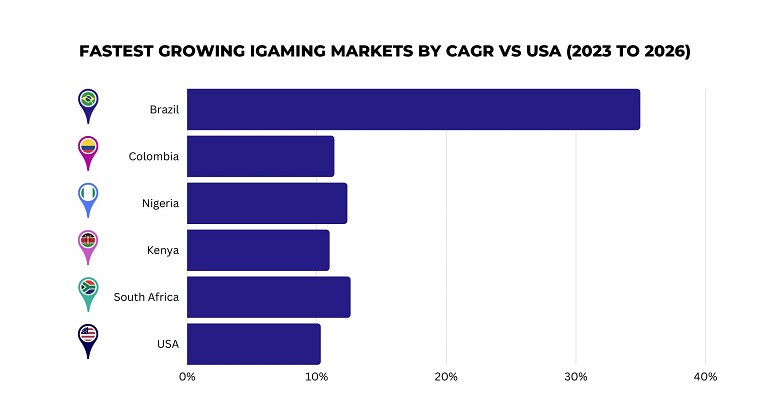

Fastest Growing Markets For iGaming And Sports Betting

Right now, for investors looking to expand their iGaming services abroad there are a few countries that should be seen as major opportunities. Brazil is definitely the first one that comes to mind, with the iGaming market expected to grow to 12billion Brazilian Reais (BRL) – around $2.3b USD – in 2023. This is a growth of 71% compared to 2020. The expected CAGR for sports betting market from 2023 to 2026 is 34.95%.

Another country with a booming iGaming market that is expanding fast is South Africa. As mentioned before, they were one of the first countries in the African continent to legislate online gambling back in the 90s. And sports betting, online poker and roulette are more popular than ever, with an expected growth of 12.6% from 2021 to 2026.

Nigeria would be another country whose iGaming industry is growing fast. Especially with the new legal framework imposed by their government, operators can now become licensed in Nigeria. It is expected than until 2026 the iGaming industry grows 12.35% in Nigeria.

Another country which we already mentioned before and that presents a chance for investment is Colombia. Their growth expectancy until 2026 is 11.35% and online gaming is regulated by Coljuegos.

And finally, Kenya, whose iGaming industry should achieve an expansion of 10.98% until 2026. However, bear in mind that Kenya does have legal online casino and sports betting, but all activities should be conducted through licensed operators.

Final Thoughts

Compared to the compound annual growth rate (CAGR) of the countries mentioned before, the U.S. is expected to grow 10.3% by 2030.

Nonetheless, the biggest obstacle for growth of sports betting and iGaming markets in U.S. are state legislators. Since most countries mentioned before normally make decisions that affect the whole of their territory, while in the U.S. these changes in laws vary from state to state.

So, the expected growth we have mentioned might change if we see some bigger states like Texas or Florida progressing with their laws. We saw Massachusetts doing it recently on sports betting, which saw fans of Boston Celtics, Red Sox and Patriots being able to bet on their teams through legal means.

So, we would not rule it as impossible that other states will join and if that happens, we might see the iGaming and sports betting industry grow more than the expected number and surpass the competition of countries abroad. Even though they present more attractive markets for investors right now, this might change in the near future.

Read our other articles

Top 5 Trends for Enterprise SEO in 2025

Enterprise Local SEO: Multi-Location Businesses for Regional Success

Crafting an Effective Enterprise SEO Strategy